Revolutionising the car insurance industry with a seamless, transparent, and affordable platform powered by data-driven customisation and third-party integrations.

Context

In a market flooded with traditional insurance providers, InsureIQ emerged with a mission: to make car insurance smart, simple, and instant using AI. However, to resonate with their tech-savvy audience and stand out in a competitive space, they needed a strong, forward-thinking brand identity from scratch.

Details

Client

InsureIQ

Industry

Insurance / AI / Fintech

Project Scope

Complete Brand Identity Design

Role

Branding, Visual Identity, Collateral Design

🎯 Objective

- Create a compelling brand identity that reflects innovation, trust, and simplicity.

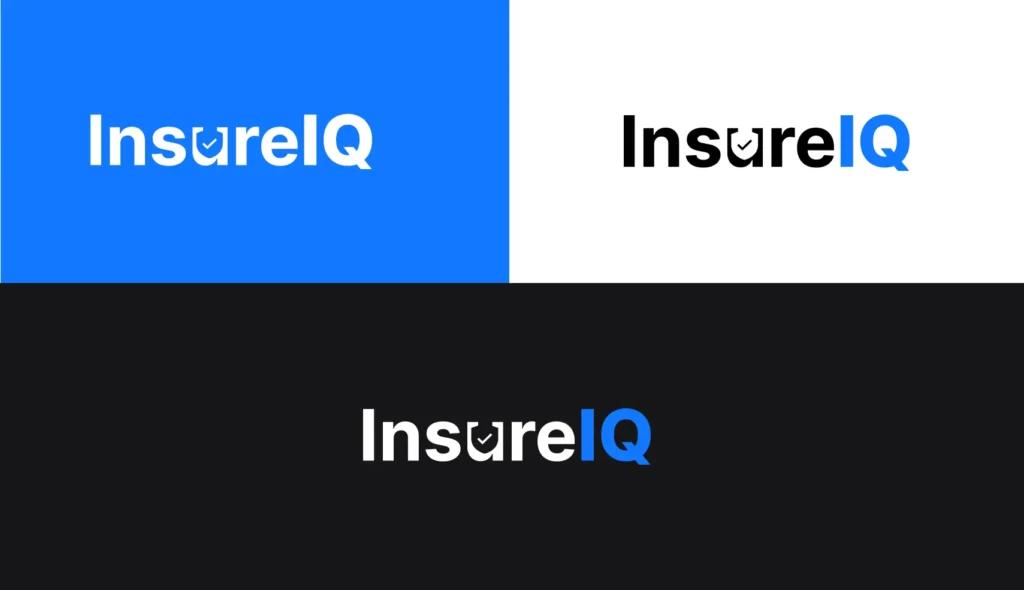

- Design a logo that is versatile, modern, and memorable.

- Develop a cohesive set of collaterals for both digital and print use.

- Ensure the brand feels intuitive and futuristic, aligned with AI and automation.

🔍 Research & Insights

- Studied direct competitors and global insurance disruptors.

- Explored user expectations for digital-first insurance brands.

- Focused on clean aesthetics, tech-forward color palettes, and subtle visual cues of motion, safety, and intelligence.

🎨 Brand Identity Development

Logo Design

- Concept: Combined elements of protection (shield), automation (circuit-inspired lines), and motion (curved dynamics).

- Typography: Modern sans-serif with customized letterforms to hint at trust and technological clarity.

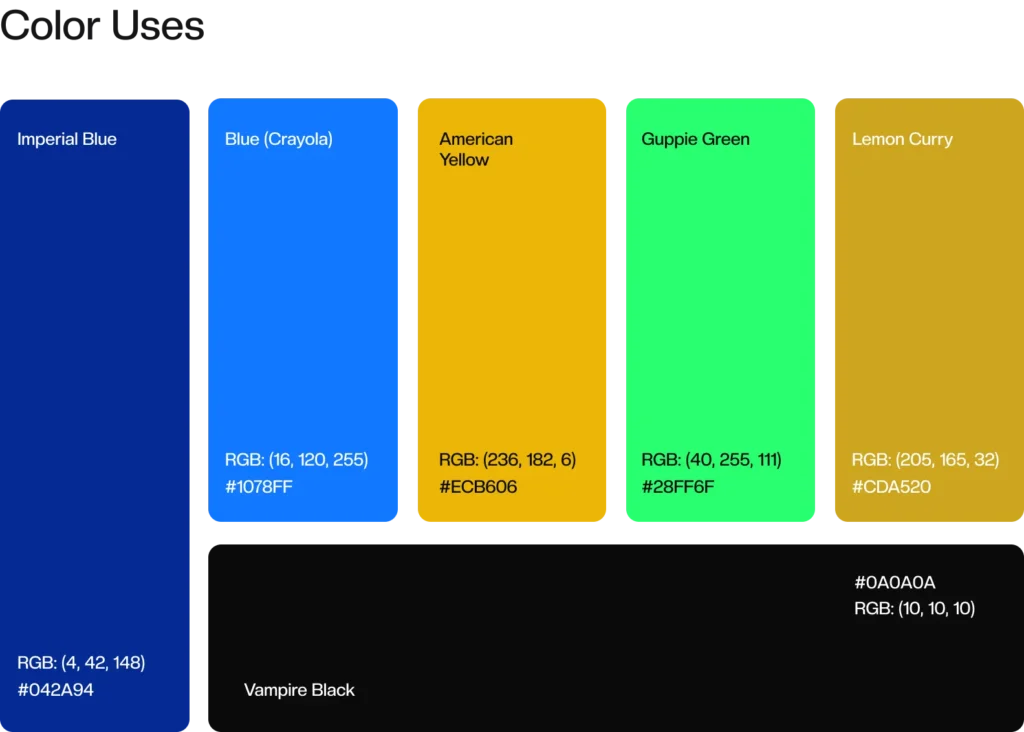

- Color Palette:

- Primary: Deep Blue (trust, stability)

- Accent: Electric Green (AI, innovation)

- Supportive Greys: For balance and modernism

Visual Language

- Iconography built on geometric foundations.

- Motion lines and gradients to express speed and AI analysis.

- Rounded corner elements to signify friendliness and approachability.

✨ Key Highlights

- Designed a modular brand system that works seamlessly across print and digital.

- Created brand guidelines to maintain consistency across future marketing campaigns.

- Maintained a balance of friendliness and sophistication to match the AI+Insurance mix.